In the world of forex trading, understanding the cost of executing trades is essential for anyone looking to maximize their profitability. One key concept that traders must grasp is the “spread.” This article delves deep into what spread is, why it matters, and how it can impact your trading strategy.

Understanding Spread: The Cost of Trading in Forex

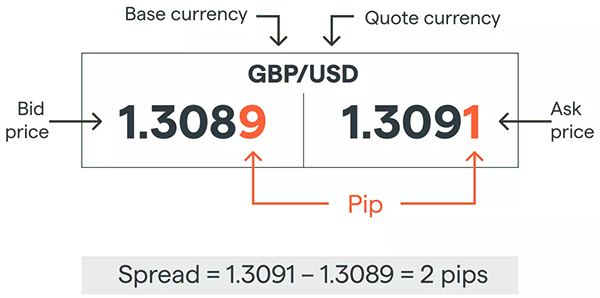

Spread refers to the difference between the bid price and the ask price of a currency pair. The bid price is the highest price a buyer is willing to pay for a currency, while the ask price is the lowest price a seller is willing to accept. The spread essentially indicates the transaction cost you will incur when entering or exiting a trade.

Example of Spread

- Bid Price: 1.2000

- Ask Price: 1.2005

- Spread: 1.2005 – 1.2000 = 0.0005 or 5 pips

In this example, if you were to buy the currency pair, you would pay 1.2005, but if you sold it immediately, you would only receive 1.2000. This difference of 5 pips represents your cost of trading.

Types of Spreads: Fixed vs. Variable Explained

Spreads can typically be classified into two main types: fixed and variable.

| Spread Type | Definition | Pros | Cons |

|---|---|---|---|

| Fixed | The spread remains constant regardless of market conditions. | Predictability; easier budgeting. | May be higher than average variable spreads during low volatility. |

| Variable | The spread fluctuates based on market conditions and liquidity. | Potentially lower costs during high liquidity. | Uncertainty; spreads can widen significantly during news events or low liquidity. |

Choosing the Right Spread Type

- Fixed Spreads: Ideal for traders who prefer consistency and want to avoid sudden changes during trading.

- Variable Spreads: Suitable for those who can monitor market conditions closely and trade during optimal times for lower costs.

How Spread Affects Your Trading Strategy and Profitability

Understanding how spread affects your trading strategy is critical. The wider the spread, the more the price needs to move in your favor for you to break even.

Impact on Profitability

- Increased Trading Costs: Wider spreads can significantly increase your costs, especially for short-term traders or scalpers who rely on small price movements.

- Break-Even Point: For every trade you make, the currency pair’s price must move beyond the spread for you to turn a profit.

Practical Tip

- Always calculate the potential impact of the spread on your trading strategy. If you’re trading pairs with wide spreads, ensure your target profit significantly exceeds the transaction cost.

The Role of Spread in Market Liquidity and Volatility

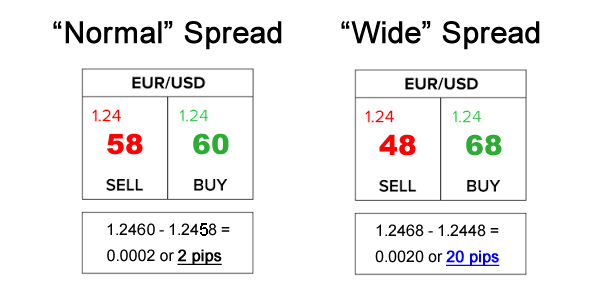

Spread is closely tied to market liquidity and volatility.

Key Relationships

- High Liquidity: In markets with high trading volumes, spreads tend to be tighter. This is because there are more buyers and sellers, reducing the difference between bid and ask prices.

- Volatile Markets: During periods of high volatility (e.g., economic news releases), spreads can widen significantly due to increased uncertainty and lower liquidity.

Impact of Market Conditions

- News Events: Be cautious during major economic announcements, as spreads can widen abruptly, increasing trading costs.

- Market Hours: Trade during peak hours when liquidity is generally higher to benefit from tighter spreads.

Comparing Spreads Across Different Forex Brokers

Different forex brokers offer varying spreads, which can influence your trading costs significantly.

Comparing Spreads: A Sample Table

| Broker | Currency Pair | Fixed Spread | Variable Spread | Average Spread |

|---|---|---|---|---|

| Broker A | EUR/USD | 2 pips | 1.5 pips | 1.8 pips |

| Broker B | GBP/USD | 3 pips | 2 pips | 2.5 pips |

| Broker C | USD/JPY | 1 pip | 0.8 pips | 0.9 pips |

Importance of Choosing the Right Broker

Consider both the type of spread and the average spread when selecting a broker. Lower spreads can result in significant cost savings over time, particularly for active traders.

Tips to Minimize Spread Costs and Maximize Returns

- Choose the Right Time to Trade: Focus on trading during peak hours when spreads tend to be narrower.

- Select Currency Pairs Wisely: Trade more liquid currency pairs (like EUR/USD) to benefit from tighter spreads.

- Use Limit Orders: In volatile markets, limit orders can help secure better prices and minimize spread impact.

- Be Aware of News Releases: Prepare for potential spread widening during major economic announcements by planning your trades in advance.

- Compare Broker Spreads: Regularly review and compare spreads across multiple brokers to ensure you’re getting the best deal.

Frequently Asked Questions (FAQ)

Q1: What is a pip in forex?

A pip is the smallest price movement that a given exchange rate can make based on market convention. Typically, it is the fourth decimal place in most currency pairs.

Q2: Do all forex brokers charge spreads?

Yes, all forex brokers charge spreads, but the type and amount can vary significantly.

Q3: Can spreads change during a trade?

Yes, spreads can change during a trade, especially in volatile market conditions or during significant news events.

Q4: How can I account for spread in my trading strategy?

Incorporate the spread into your trading strategy by adjusting your entry and exit points to ensure profitability after accounting for the transaction cost.

Q5: What is a spread betting?

Spread betting involves betting on the price movement of financial instruments without actually owning the underlying asset, and it’s often used in conjunction with forex trading.

Q6: How is spread different from commission?

Spread is the difference between bid and ask prices, while commission is a fee charged by the broker for executing a trade.

Q7: Are there brokers with no spread?

Some brokers may offer zero spreads on certain accounts, but they often compensate with higher commissions or fees elsewhere.

Understanding the spread in forex trading is crucial for optimizing your trading performance and profitability. By actively managing how spread impacts your trades, you can enhance your overall trading strategy and make more informed decisions.

I learned that spread is the cost of trading. Very helpful!

Good to know about the average spreads from different brokers.

Understanding spreads can really change your trading strategy. Thanks!

‘Limit orders’ seem smart to minimize spread impact. Good advice!

This article explains fixed and variable spreads well. Good info!

‘Variable spreads’ sound tricky but necessary to understand.

‘Pip’ is new for me! Thanks for explaining it clearly.

I didn’t know spreads could widen during news events. Important tip!

‘Spread’ seems crucial for profits in forex trading. Great read!

‘Choosing the right broker’ can save a lot on trading costs.

| Powered by WordPress | Theme by TheBootstrapThemes