Understanding how to read Forex charts is essential for any trader aiming to make informed decisions in the foreign exchange market. With the right approach, you can develop a keen eye for market movements, identify trends, and ultimately enhance your trading strategy. This article will break down the fundamentals of reading Forex charts and provide practical tips and insights that will elevate your trading skills.

Understanding the Basics of Forex Chart Types and Patterns

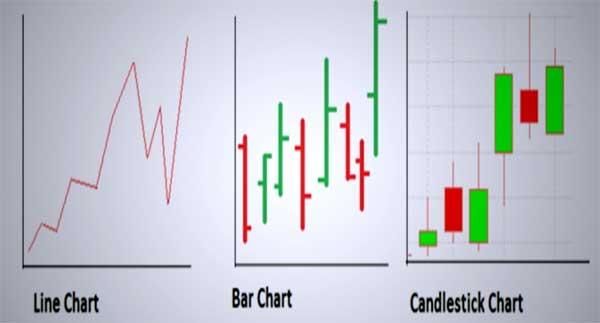

Forex charts come in various types, each serving a unique purpose. Here are the most common types:

- Line Charts: These charts display the closing prices over a set period and provide a simple overview of price movements.

- Bar Charts: These offer more detail by showing the opening, closing, high, and low prices within a given timeframe.

- Candlestick Charts: The most popular among traders, candlestick charts illustrate price movements through colored “candles” that represent time intervals.

Comparative Table of Chart Types

| Chart Type | Description | Best For |

|---|---|---|

| Line Chart | Displays closing prices over time. | Quick overview of trends |

| Bar Chart | Shows opening, closing, high, and low prices. | Detailed price analysis |

| Candlestick Chart | Highlights price movements with colored candles. | Visual interpretation of market sentiment |

Key Indicators: What to Look for in Forex Charts

While understanding the chart types is essential, knowing which indicators to focus on can enhance your analysis. Here are some key indicators to watch:

- Moving Averages: These smooth out price data to identify trends over specific periods (e.g., 50-day, 200-day).

- Relative Strength Index (RSI): An oscillator that assesses whether a currency pair is overbought or oversold.

- MACD (Moving Average Convergence Divergence): A momentum indicator that shows the relationship between two moving averages.

Mastering Candlestick Analysis for Better Trading Decisions

Candlestick patterns are critical in predicting potential market movements. Here are some common patterns to recognize:

- Doji: Indicates indecision in the market; potential reversal signal.

- Hammer: A bullish reversal pattern found at the bottom of a downtrend.

- Engulfing Pattern: A strong reversal signal that can signify a shift in momentum.

Practical Tips for Candlestick Analysis

- Look for Patterns: Familiarize yourself with various candlestick formations and their implications.

- Confirm with Indicators: Use other indicators like RSI or Moving Averages to confirm signals from candlestick patterns.

The Role of Support and Resistance Levels in Forex Trading

Support and resistance levels are crucial for identifying potential entry and exit points in Forex trading.

- Support Levels: Price points where a currency pair tends to stop falling and may bounce back.

- Resistance Levels: Price points where the currency pair tends to stop rising before reversing.

How to Identify Support and Resistance

- Historical Highs and Lows: Look for price levels where the market has reversed in the past.

- Psychological Levels: Round numbers often act as psychological barriers (e.g., 1.2000).

- Trend Lines: Use trend lines to connect highs and lows to further pinpoint these levels.

Utilizing Trend Lines to Enhance Your Trading Strategy

Trend lines help traders visualize the direction of price movements. By drawing lines that connect the highs in a downtrend or lows in an uptrend, you can identify potential breakout points.

Practical Steps for Drawing Trend Lines

- Identify Highs and Lows: Use recent price movements to find significant peaks and valleys.

- Draw the Line: Connect at least two or three points to create a valid trend line.

- Monitor Breakouts: A break above a downward trend line may signal a buy opportunity, while a break below an upward trend line could indicate a sell signal.

Common Mistakes to Avoid When Reading Forex Charts

Reading Forex charts can be daunting, and traders often fall into common pitfalls. Here are some common mistakes to avoid:

- Ignoring Time Frames: Analyzing a single timeframe may lead to misinterpretations. Always consider multiple timeframes for a comprehensive view.

- Overcomplicating Analysis: Using too many indicators can lead to confusion. Focus on a few reliable indicators that align with your strategy.

- Neglecting Economic News: Market-moving events can drastically impact price movements. Always stay updated on economic news that can affect the Forex market.

Summary of Key Points

- Understand various chart types and their applications.

- Focus on key indicators that provide insights into market conditions.

- Master candlestick analysis for improved trading decisions.

- Utilize support and resistance levels for strategic trades.

- Draw trend lines to visualize market direction.

Frequently Asked Questions (FAQ)

1. What is the best chart type for beginners?

Line charts are often recommended for beginners as they provide a simple view of price movements without any distractions.

2. How can I tell if a market is trending?

You can identify trends using moving averages and trend lines to confirm whether the price is moving in a consistent direction.

3. What are the most reliable candlestick patterns?

The hammer, doji, and engulfing patterns are among the most reliable for indicating potential reversals.

4. How often should I update my charts?

Updating your charts regularly, ideally in real-time as you trade, is crucial to staying informed about market conditions.

5. What impact do economic events have on Forex trading?

Economic events can lead to significant price fluctuations, making it vital to monitor news releases and economic indicators that affect currency values.

6. Can I use multiple indicators at once?

Yes, but it’s essential to avoid clutter. Focus on a few indicators that complement each other to enhance your analysis without causing confusion.

7. How do I practice reading Forex charts?

You can practice by demo trading on platforms that offer virtual accounts, allowing you to hone your chart-reading skills in a risk-free environment.

This article explains the different types of Forex charts really well. I learned about line, bar, and candlestick charts.

I didn’t know that candlestick patterns are so important for trading. The hammer and doji patterns sound interesting!

The FAQ section answers many questions that beginners like me have. It’s great to have this resource!

Moving averages are mentioned here a lot. I want to understand how to use them better in my trades.

‘Understanding chart types’ is key for me as a beginner. Line charts seem simple and effective!

Thanks for the tips! I never thought about psychological levels when trading. This is new information for me.

The section on support and resistance levels is helpful. I think it will help me make better trading decisions.

‘How often should I update my charts?’ is something I’ve been wondering about too! Good info here.

‘Avoiding common mistakes’ is crucial advice! I often ignore time frames and need to be more careful.

‘Using multiple indicators’ sounds useful, but I’ll keep it simple as you suggest. Thank you for the advice!

| Powered by WordPress | Theme by TheBootstrapThemes