Forex trading involves the buying and selling of currencies on a global scale. Unlike traditional stock markets that have fixed operating hours, the Forex market is open 24 hours a day, five days a week. Understanding Forex market hours is crucial for traders who wish to optimize their strategies and stay informed about currency fluctuations. This article provides a comprehensive guide to Forex market opening and closing times, helping traders make educated decisions.

Understanding Forex Market Hours: A Comprehensive Guide

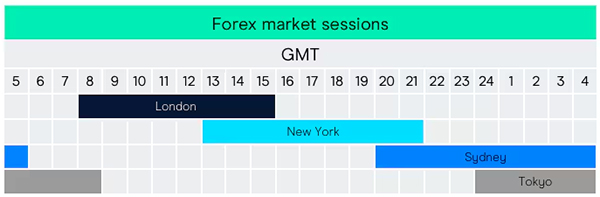

The Forex market operates through different trading sessions that correspond to major financial centers worldwide. The market is divided into four primary trading sessions: Sydney, Tokyo, London, and New York. Each session overlaps with others, creating ample opportunities for traders.

Trading Sessions Overview

- Sydney Session: Opens at 10 PM GMT, closes at 7 AM GMT.

- Tokyo Session: Opens at 12 AM GMT, closes at 9 AM GMT.

- London Session: Opens at 8 AM GMT, closes at 5 PM GMT.

- New York Session: Opens at 1 PM GMT, closes at 10 PM GMT.

The Global Nature of Forex Trading Sessions Explained

Forex trading is a continuous process that takes place across different global financial centers. The unique aspect of this market is that it operates around the clock due to the time zone differences. Traders need to be aware of these sessions to maximize their trading potential.

Key Characteristics of Each Session

- Sydney Session: Generally quieter, suitable for low volatility strategies.

- Tokyo Session: Active for Asian currencies and offers moderate volatility.

- London Session: Considered the most volatile, with significant trading volume and liquidity.

- New York Session: Active for U.S. dollar pairs, leading to impactful price movements.

Key Time Zones: When Does the Forex Market Open?

Understanding the opening hours of each trading session can give traders a competitive edge. Below is a comparative table displaying key time zones for each session:

| Trading Session | Opening Time (GMT) | Closing Time (GMT) | Overlap with Other Sessions |

|---|---|---|---|

| Sydney | 10 PM | 7 AM | Overlaps with Tokyo |

| Tokyo | 12 AM | 9 AM | Overlaps with Sydney |

| London | 8 AM | 5 PM | Overlaps with New York |

| New York | 1 PM | 10 PM | Overlaps with London |

Practical Tips for Global Time Zones

- Convert Times: Use a time zone converter to ensure you are trading at the right times.

- Set Trading Reminders: Utilize calendar alerts to remind you of session openings and closings.

The Impact of Market Opening on Currency Fluctuations

Market openings are crucial periods when significant price movements often occur due to fresh market sentiment. The release of economic data, geopolitical events, and changes in market sentiment can all contribute to currency fluctuations.

Key Influencers at Market Open

- Economic Reports: Data releases such as GDP, employment figures, and inflation rates can trigger volatility.

- Market Sentiment: Global events or news can sway trader sentiment, influencing buying and selling pressure.

- Liquidity: Higher liquidity typically occurs when multiple sessions overlap, resulting in more substantial price movements.

Example Scenario

When the London session opens, traders can expect increased activity as European traders join the market. This often leads to higher volatility in major currency pairs like EUR/USD and GBP/USD.

Closing Times: What Traders Need to Know and Why

Just as market openings are crucial, so are market closings. The closing of a session can signal the end of trading activity for that particular day, leading to reduced liquidity and increased spreads.

Considerations for Trading Near Closing Times

- Position Management: Close trades before the end of a session to avoid unexpected volatility.

- Spread Awareness: Be mindful of wider spreads during closing times as liquidity decreases.

- Review Performance: Use closing times to assess your trading strategies and make improvements for the next session.

Strategies for Trading During Market Opening and Closing

1. Monitor Economic Calendars: Keep an eye on scheduled economic releases and their expected impact.

2. Use Technical Analysis: Employ charting techniques to identify potential entry and exit points during high volatility periods.

3. Adjust Position Sizes: Modify your position sizes based on market conditions, especially near session openings and closings.

4. Stay Informed: Follow news and economic reports that can influence currency pairs, particularly during market open times.

5. Utilize Stop-Loss Orders: Protect your investments by setting stop-loss orders, especially during volatile periods.

Frequently Asked Questions (FAQ)

Q1: Why is the Forex market open 24 hours?

A1: The Forex market operates 24 hours due to its global nature, allowing traders from different time zones to participate.

Q2: What is the best time to trade Forex?

A2: The best time to trade Forex is during overlapping sessions, particularly the London/New York overlap, as it tends to have the highest liquidity and volatility.

Q3: How does the market open impact currency prices?

A3: The market open can lead to significant price movements due to new information, trader sentiment shifts, and the influx of trading activity.

Q4: What should I be cautious of during market closings?

A4: Be wary of lower liquidity, wider spreads, and potential unexpected price movements during market closing times.

Q5: How can I stay updated on market hours?

A5: Utilize online trading platforms, economic calendars, and financial news websites to stay informed about Forex market hours and events.

In conclusion, understanding Forex market opening and closing times is essential for effective trading. By keeping track of global sessions, traders can enhance their strategies and optimize their trading outcomes.

Great article! Understanding the opening hours can help me plan my trades better.

The tips about converting times and setting reminders are really useful! Thanks for sharing.

I didn’t know the Forex market was open 24 hours. This is very helpful for someone who wants to trade.

I had no idea that market openings could cause big price changes. I will pay more attention to that.

‘Using stop-loss orders’ sounds smart, especially during volatile times. Thanks for the advice!

‘The London session being most volatile’ is good to know. I’ll keep an eye on that one!

The session overlaps are interesting. I will try to trade during those times for better opportunities.

I learned about the different sessions like Sydney and New York. It makes trading seem less confusing now!

Learning about Forex trading sessions makes me want to start trading right away!

‘Economic reports’ influencing currency prices is something I need to watch out for when trading.

| Powered by WordPress | Theme by TheBootstrapThemes